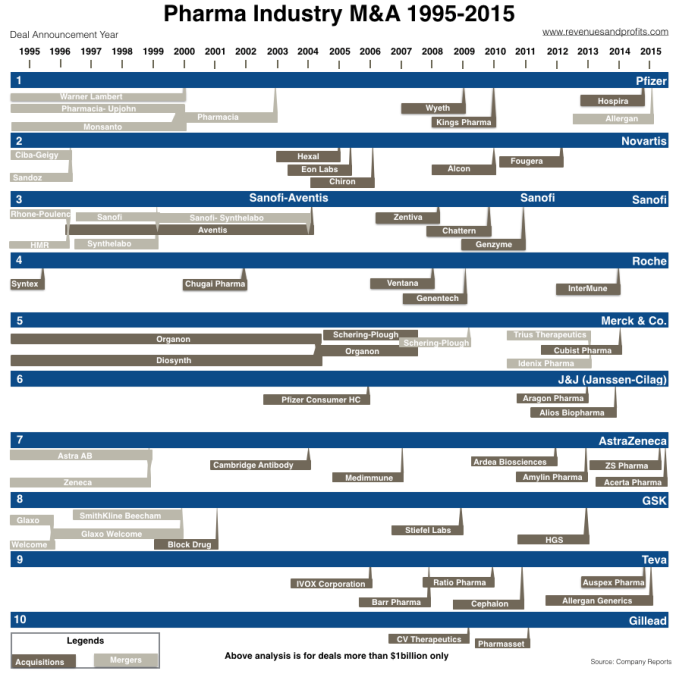

Mergers and acquisitions are commonplace in the pharmaceutical industry, there are reports of it every other week. Pfizer for example, has just recently announced it will acquire Medivation for 14 billion dollars, a move that will bolster its presence in the immuno-oncology field. And here’s a list of other notable acquisitions over the past few years involving Amgen, Gilead, Celgene, Bristol-Myers and Merck. Acquisitions in pharma have been occurring so much that this graphic from revenuesandprofits.com depicts the consolidation of 60 pharmas into just 10 over the past two decades:

Why do pharma companies like merging and acquiring so much? They do it mainly for the following reasons:

- To improve their own performance

- To consolidate resources and reduce wastage

- To accelerate their product’s access to the market

- To obtain or increase access to a specific market

- To acquire a new technology

- To pick an early “winner” or to buy cheap

- To eliminate competition

So back to the Pfizer-Medivation example. By buying Medivation, Pfizer gets access to the blockbuster anti-prostrate cancer drug, Xtandi, which brings in $2.2 billion/year. Furthermore, there is still potential for Xtandi to be used in other cancers, with projected sales of $4.78 billion in 2020. Pfizer would also gain access to other cancer drugs in Medivation’s pipeline, like promising breast cancer drug talozoparib, increasing its overall access to the cancer market. It all seems like a very logical move.

So the only thing that could make it a bad move, is if they are paying more than they would ever get back. Pfizer is constantly criticized for paying more than it should and its happening again now. Pfizer paid $81.50 per share of Medivation, a 180% premium on Medivation’s share price when talk of the deal first started, and a 55% premium over Sanofi’s offer of $52.50 per share. So yes, they are paying alot. But if Xtandi and Medivation’s other drugs outperform and outsell, then we can all look back and think it was a bargain! So I’ve tricked you, you can’t really tell if an acquisition is good or bad unless you’re the Oracle.

Alright, don’t be mad. There are some key things to take note of that could be warning signs an M&A is going to go wrong:

- It happens for the wrong reasons. E.g. Driven by the fear that one has to be big to survive, or driven by glory – a whole lot of people including lawyers and accountants stand to gain big bonuses when they mediate a M&A.

- The company is too focused on cost-cutting and integrating the new acquisition, neglecting the running of its day-to-day business.

- Culture clashes. Here are some examples.

But overall, how have pharma acquisitions performed in the past? Surely Pfizer having bought numerous companies before in the past, would be an expert in cleverly acquiring new companies. Well yes, on paper, they’ve got it down pat. In fact, the whole pharma industry in general, perform uniquely when it comes to mergers and acquisitions, increasing shareholder return by an average of 5% according to a McKinsey report.

Note that this is shareholder return. Not patient return, or research return. Its no secret that lots of people lose their jobs when pharmas merge, and research cuts are always made as managers try to consolidate overlaps. As a result, science tends to slow down. In the long run as well, competition drops and innovation declines. The drop in innovation may be mitigated by the consistent rise of biotech start-ups, pumping the industry with new ideas. But with the high failure rate of start-ups, how efficient can this process be?

Another option to maintain innovation and a fair amount of competition, is for large pharmas to start spin-offs themselves, which is already happening. Pfizer spun off its animal health unit Zoetis in one of the biggest IPOs in 2013. Abbot also spun off its pharmaceutical unit, now called AbbVie which has surged to become even more valuable than Abbot itself. Pharmas are even starting to swap asset classes, which may be good for science overall – imagine if we all focused on doing what we are good at.

So it looks like M&As (good and bad) are here to stay in pharma, and in fact, may even be key to the renewal and exchange of ideas.